The Interlink Private Office is a permanent capital single family office co-investment vehicle that was formed in 1994 as a direct and fund of funds investor to identify opportunities to invest alongside other family offices, operating investors, and top tier new economy funds in the TMT (telecom, media & technology) sectors. The family office was created to provide investment opportunities to the families of our founding partners.

The success of our approach has allowed us to expand our capabilities and develop a co investment program investing alongside other investors under a formal structure.

Our primary focus is to invest in direct global private equity investments with minority equity stakes and in select early to late-stage VC investments where there are lead marquee sponsor investors. We seek opportunities during periods of extreme liquidity gaps in global markets.

Equity check size per transaction up to a maximum of $100 million across all sectors.

We seek to partner with operating investors that bring top tier market presence, industry-leading expertise and management oversight. Our DNA reflects the family heritage and culture of our founders, with a commitment to empowering portfolio investments through the fourth industrial revolution.

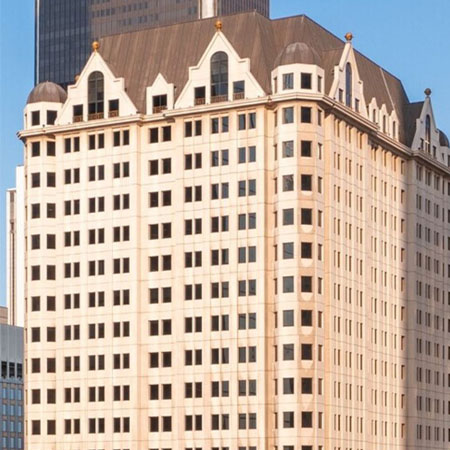

Single Family Office

As a direct investor, we seek investments in global private equity through club co-investments, minority equity and syndicated control equity stakes. We can invest equity up to $100 million per company.

Investment Strategy

We are opportunistic and are never a momentum investor. Our focus revolves around investment opportunities in both the private and public markets which are not speculative in nature and where human and technology capital are key differentiators.